Showing that there’s real investor enthusiasm for identity management platforms, Saviynt, which enables companies to secure apps, data and infrastructure in a single platform, today announced that it raised $205 million in debt from AB Private Credit Investors’ Tech Capital Solutions group.

Founder Sachin Nayyar, who returned to Saviynt as CEO this week alongside newly appointed president Paul Zolfaghari, said that the loan will be put toward expanding Saviynt’s platform, acquiring customers and growing the company’s partner ecosystem. He noted that the investment brings Saviynt’s total raised to date to $270 million following a $130 million debt raise in 2021, making Saviynt one of the better-funded startups in the identity management space.

Asked why Saviynt opted for debt as opposed to equity, Nayyar says that it was “the best funding option aligned to the company’s growth needs.” It’s also, perhaps, a reflection of the tough economic reality. Global venture funding in 2022 declined 35% year over year from 2021, according to Crunchbase data, while Q4 2022 saw the lowest amount invested since Q1 2020. As traditional capital becomes tougher to attain, venture debt — which was already gaining traction in some entrepreneurial circles — is expected to become big for startups in 2023.

“Despite the current funding environment, the investment interest was especially strong for a high-growth identity company like Saviynt,” Nayyar told TechCrunch in an email interview. “Identity management is a priority area of spending among large enterprises and mid-sized companies even during this volatile economic period because identity has become the new perimeter and is critical to cyber security.”

It probably helps that identity management is having a moment, thanks in part to the lingering effects of the pandemic. The transition to remote work forced companies to reevaluate the way they identify users and control access to assets on their networks. One pandemic-era survey found that 61% of companies planned to increase their identity access management budgets in 2021. Investors, chasing after the trend, have upped their stakes in identity management; Crunchbase reports that $3.2 billion in venture dollars went into the identity management sector in 2021, up 2.5x from last year’s $1.3 billion.

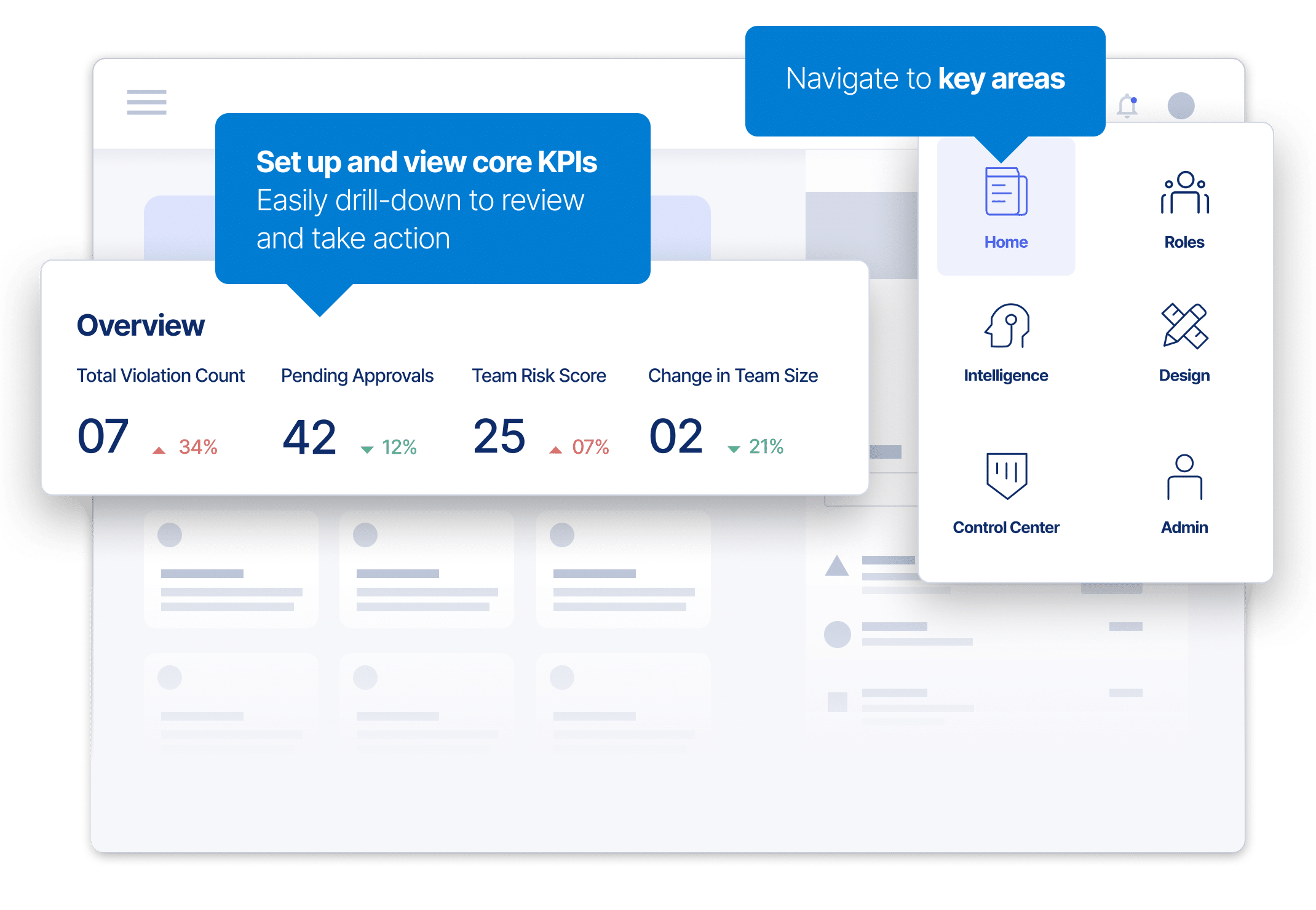

Image Credits: Saviynt

Nayyar founded Saviynt in 2011 and stayed on until 2018 prior to his most recent stint. Before launching the company, Nayyar was the chief identity strategist at Sun Microsystems and president of Brinqa, the cybersecurity risk management platform. After leaving Saviynt, Nayyar served as the CEO of cybersecurity firm Securonix, where he led a $1 billion-plus growth investment from Vista Equity Partners last year.

With Saviynt, Nayyar says that the goal was to address what he saw as a significant enterprise market need: an agile, cloud-native and converged identity platform for workforce, enterprise app, privileged and third-party identities. That’s jargony. But basically, Nayyar sought to do away with the need to juggle multiple identity management tool license schemes and integrations to make identity products work together.

Using Saviynt, companies can secure and control access to assets, apps and infrastructure — whether on-premises, hybrid or across multiple clouds. The platform provides workflows to simplify identity lifecycle management and dashboards designed to help prioritize remediations.

Those aren’t exactly groundbreaking features. Nayyar acknowledges that vendors like SailPoint, CyberArk and Okta offer comparable tech, and they’re not the only competition. ID management platform ForgeRock raised $275 million and reached a $2.8 billion valuation in an IPO two years ago, while startups like ConductorOne — which brings automation to identity and access management — are nipping at incumbents’ heels.

Nayyar asserts, though, that most of its rivals have simply pieced together various disparate tech through acquisitions rather than build a converged platform from the ground up. Take that with a massive grain of salt — Nayyar has a product to pitch, after all — but it’s true that Saviynt’s solution is fairly holistic.

Curiously, when asked about Saviynt’s customer base and revenue growth, Nayyar wouldn’t give numbers, saying only that revenue and customers have “more than doubled” since 2020. (He didn’t say how many employees Saviynt has, either, or indicate whether it plans to grow its workforce within the next year.) That doesn’t instill a lot of confidence in Saviynt’s trajectory; one assumes Saviynt would be eager to share the figures if they were favorable. But with Nayyar back at the helm and the massive new loan, Saviynt’s leadership is evidently intent on righting the ship.

For his part, Alex Barry, the head of originations for AB Tech Capital Solutions, said: “We look forward to working with such a talented management team and prominent investor base at Saviynt. The company’s strong financial performance and market opportunity supports our expectation for a long-term, successful relationship.”

https://techcrunch.com/

Last week, the video game giant Riot Games revealed that hackers had compromised its “development environment” — where the company stores its source code — with a social engineering attack. While the company reassured its users that “there is no indication that player data or personal information was obtained,” the hack could still be damaging, as hackers […]

Royal Mail CEO Simon Thompson has confirmed that a cyberattack is to blame for the ongoing disruption at the U.K. postal giant. The admission comes almost a week after Royal Mail first said it was hit by an unspecified “cyber incident” that left the British mail service unable to dispatch items to overseas destinations. “We’ve confirmed that we’ve had a […]

TikTok announced today that it’s launching the beta version of a revamped creator fund called the “Creativity Program.” The company says the program is designed to generate higher revenue and unlock more opportunities for creators. The program is available starting today to select creators on an invite-only basis, with availability to all eligible creators coming soon. Given […]

Leave a Reply